Author: shaunda devens,Blockworks Research

Compiled by: Deep Tide TechFlow

Deep Tide Guide: With the HIP-3 proposal advancing, Hyperliquid is accelerating its expansion from the cryptocurrency sector into traditional finance (TradFi) assets. The recent sharp volatility in the silver market provided an excellent stress test for this decentralized derivatives protocol.

This article provides an in-depth micro-level performance comparison between Hyperliquid and traditional futures giant CME (Chicago Mercantile Exchange) during extreme market conditions and weekend closures, using detailed trade, quote, and order book data.

The research finds that although it still cannot match the depth of traditional giants, Hyperliquid demonstrates unique competitive advantages in retail-level order execution and "24/7 all-weather price discovery," even becoming an important reference tool for pricing the Sunday open.

Full Text Below:

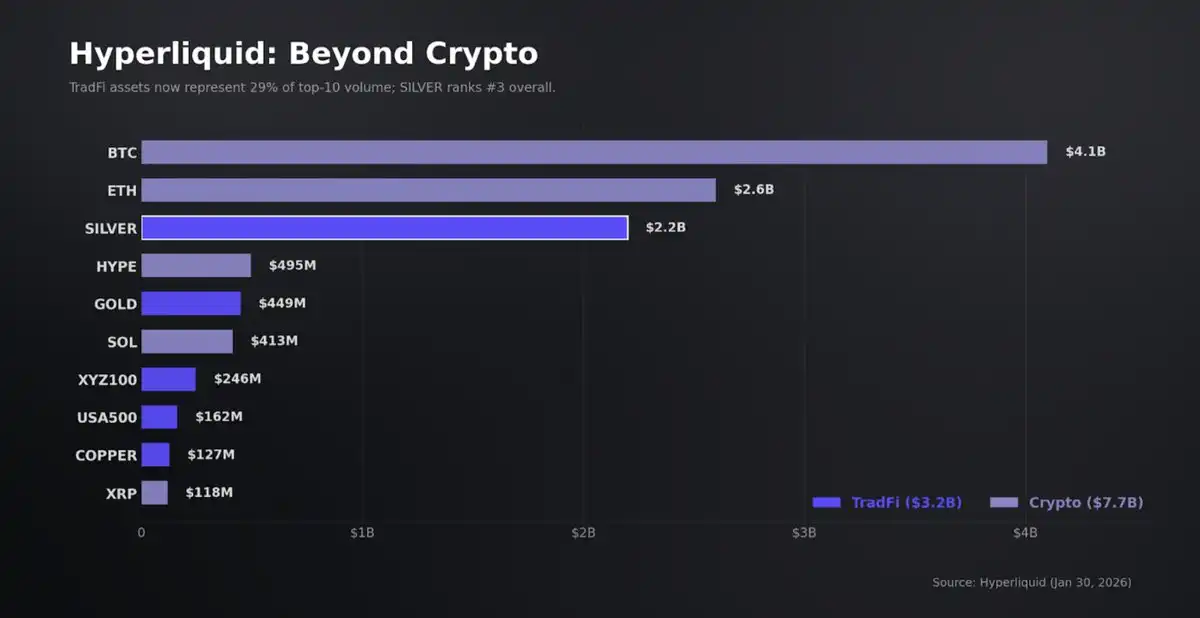

HIP-3 is pushing Hyperliquid beyond the crypto space, with TradFi instruments now accounting for 31% of the platform's trading volume and a daily average notional trading volume exceeding $5 billion. Silver is the most significant part of these flows, and last Friday's sharp price action provided a stress test for HIP-3's market health.

Using high-frequency trade/quote/order book data and benchmarking against CME/COMEX Micro Silver futures, we found that for smaller, retail-weighted orders, Hyperliquid Silver offered narrower spreads and better execution before the crash. We also demonstrate a novel 24/7 use case: positioning and pricing ahead of the Sunday reopening auction.

Key Findings:

- Pre-Crash: At the typical trading sizes for perpetual swaps, Hyperliquid was highly competitive at the top-of-book. Its median spread was 2.4 basis points (bps), compared to 3 bps for COMEX; its median execution slippage was only 0.5 bps worse than the benchmark. Flows were predominantly retail-sized (median trade size $1,200), with depth that was robust but relatively limited: Hyperliquid had about $230k depth within ±5 bps, compared to ~$13 million for COMEX.

- During the Crash: Performance degraded on both platforms, but Hyperliquid showed heavier execution risk in the tails. Hyperliquid's spreads widened by 2.1x, while COMEX's widened by 1.6x. The market deviated from the benchmark by over 400 bps at one point before mean-reverting via funding rates. The main point of degradation was execution quality: 1% of Hyperliquid trades executed more than 50 bps away from the mid price, whereas COMEX had none.

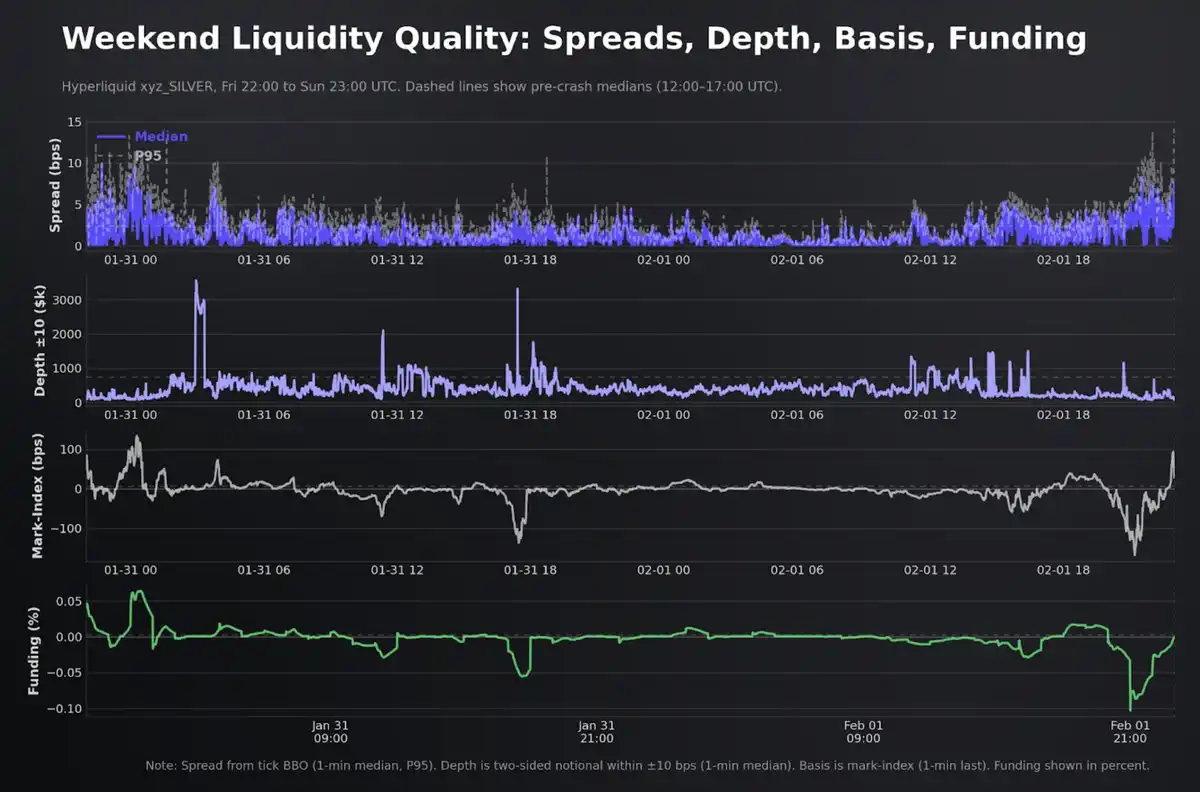

- Weekend Period: Hyperliquid was the only exchange-like, order-driven silver derivatives platform trading continuously while COMEX was closed. It processed 175k trades with $257 million in notional volume over 49 hours, with median spreads compressing to 0.93 bps. However, HIP-3 weekend trading is structurally thinner, with volume at 0.31x weekday levels.

- We believe pricing the reopen and staging hedges before a single-price auction are core use cases for 24/7 trading. However, based on the current performance of Hyperliquid's equity assets, pre-open price prediction is not significantly better than the Friday close.

HyperLiquid: HIP-3 Captures Volume

The silver market faced a structural liquidity event last week. As retail, futures, and regional spot market liquidity demand surged simultaneously, silver prices revalued sharply. Silver fell ~17% from peak to trough on high volume; US retail investors poured ~$170 million into silver ETFs in a single day, reportedly the largest single-day inflow on record, nearly double the peak of the 2021 "silver-squeeze." Meanwhile, COMEX activity accelerated to multi-year highs, and the Shanghai Gold Exchange price showed a double-digit dollar premium to the London benchmark.

More importantly for the crypto industry, these flows were not confined to TradFi platforms. As volatility spiked and traditional commodity markets approached the weekend, incremental demand for metal exposure migrated to 24/7 derivatives platforms, where position adjustments and risk transfer could continue unimpeded by trading hours.

On Hyperliquid, the Silver perpetual contract settled billions in notional volume throughout the week. Equity and commodity perpetuals under HIP-3 also pushed to new highs, with daily volume scaling from a base of $378 million 66 days ago to $4.8 billion. By Friday, TradFi-linked instruments accounted for ~31% of the platform's total volume. Silver jumped into the top tier of the platform's most active contracts, with a material shift in activity composition: five of the top ten contracts by volume on Friday were non-crypto assets.

We have consistently viewed HIP-3 as a scalable Delta-one wrapper. The returns are linear, the contracts have no expiry, and carry costs are expressed through funding and basis rather than option-like time decay.

From an investment perspective, a trading platform that extends beyond crypto can add differentiated, cycle-agnostic revenue streams. This is significant because Hyperliquid's protocol revenue ranks high in volatility, with weekly revenue volatility around 40%. Furthermore, implied analysis suggests that capturing even a small fraction of TradFi derivatives flow could more than double revenue, representing a viable path for step-function growth.

However, whether these markets can scale depends on three implementation constraints: a continuous and resilient oracle design, order book depth sufficient to maintain price mark integrity, and reliable hedging paths when the underlying reference market is discontinuous. Within this framework, the silver event was the first meaningful stress test for Hyperliquid's TradFi-linked perpetuals, using COMEX as a benchmark.

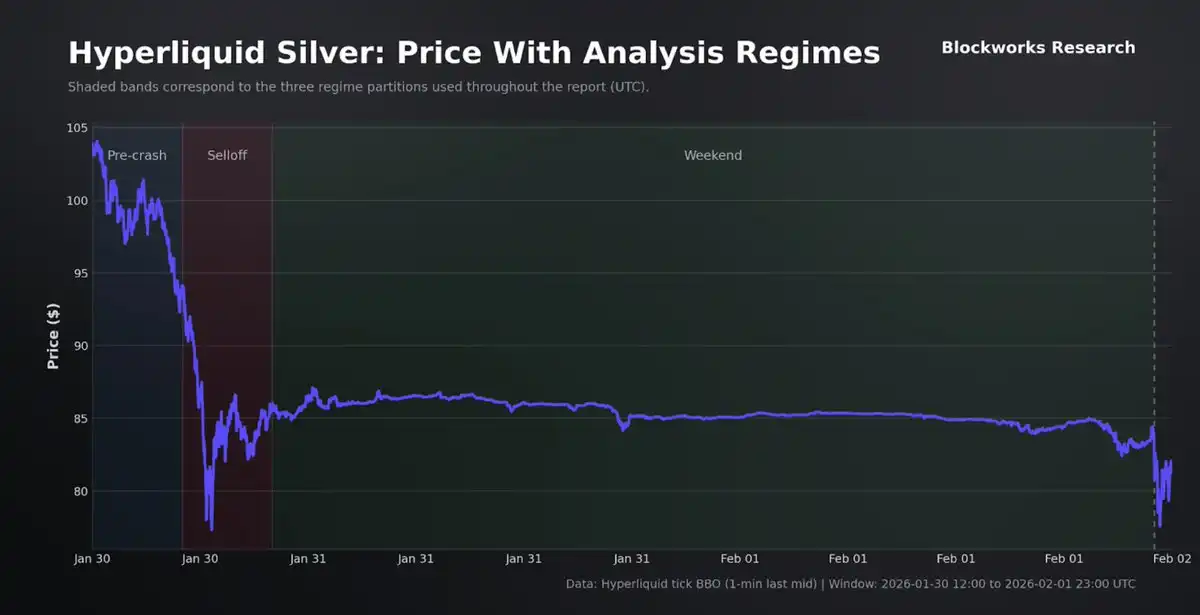

This report evaluates performance across three phases (pre-deviation, sell-off, weekend) and measures price integrity, liquidity resilience, and risk engine behavior when external markets are impaired or closed. We anchor the analysis by comparing Hyperliquid's pricing, basis, and liquidity metrics against COMEX during overlapping trading hours, then use the "weekend-to-reopen" transition to quantify catch-up behavior.

Ultimately, our goal is to answer: Are Hyperliquid's HIP-3 products suitable venues for trading perpetual equity/commodity exposure, and has Hyperliquid created a high-performance 24/7 market for stocks and commodities?

Data

We use tick-level trade, quote, and order book data from Hyperliquid's Silver perpetual contract (XYZ100), benchmarked against COMEX (a designated contract market under CME Group) front-month Silver futures (SILH6).

For Hyperliquid, we use the market deployed by TradeXYZ, as it consistently carries the highest HIP-3 volume.

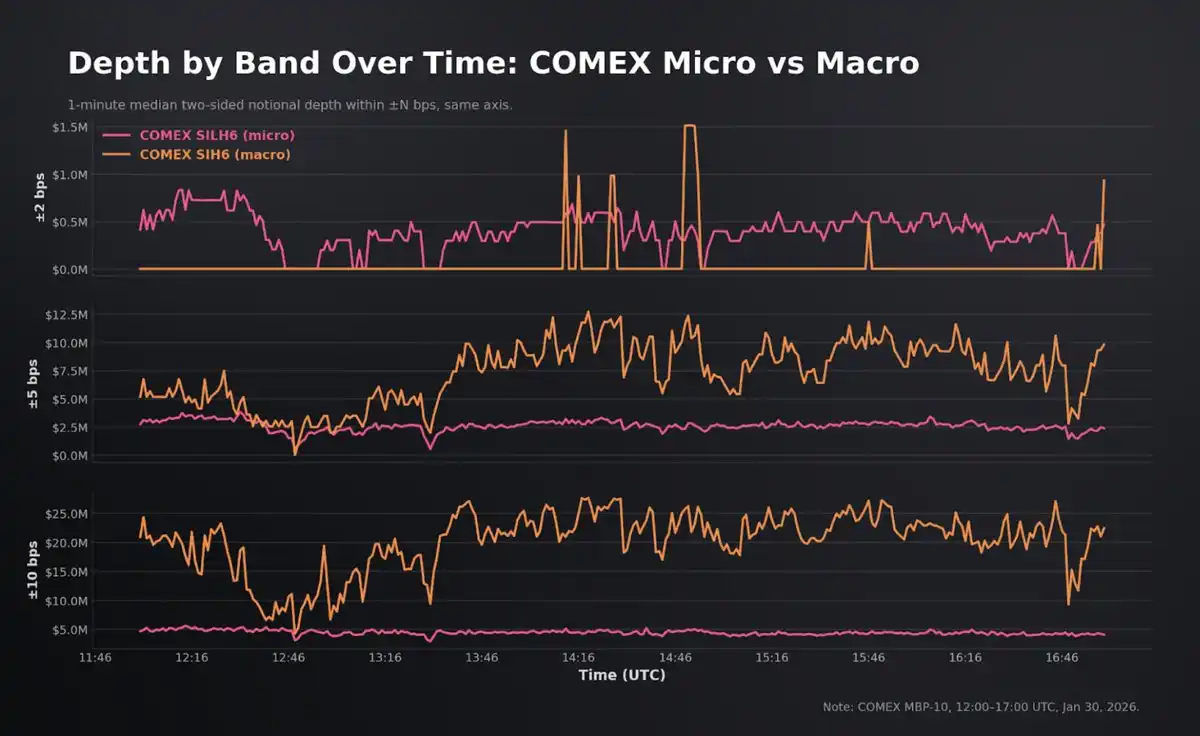

We compare Hyperliquid to COMEX Micro Silver (SILH6) because its unit size better matches the "retail-to-midscale" order distribution on the perpetual. On crash day, SILH6 traded 641,926 lots (~642 million oz, ~$50-77B notional at $78-120/oz), while the macro contract (SIH6), though deeper, generally showed worse spreads and slippage pre-crash. As this report focuses on execution quality at typical perpetual sizes, SILH6 is the most relevant COMEX reference.

The dataset spans Jan 30 – Feb 1, containing 540k Hyperliquid trades and 1.3M depth snapshots, benchmarked against 510k COMEX trades on crash day and full 10-level order book data. We split the analysis into three phases: Pre-Crash (Friday UTC 12:00–17:00), Sell-off (UTC 17:00–22:00), and Weekend (Friday close to Sunday reopen).

Pre-Crash Market

We begin with the pre-crash baseline, where both COMEX and Hyperliquid were trading normally with external references intact.

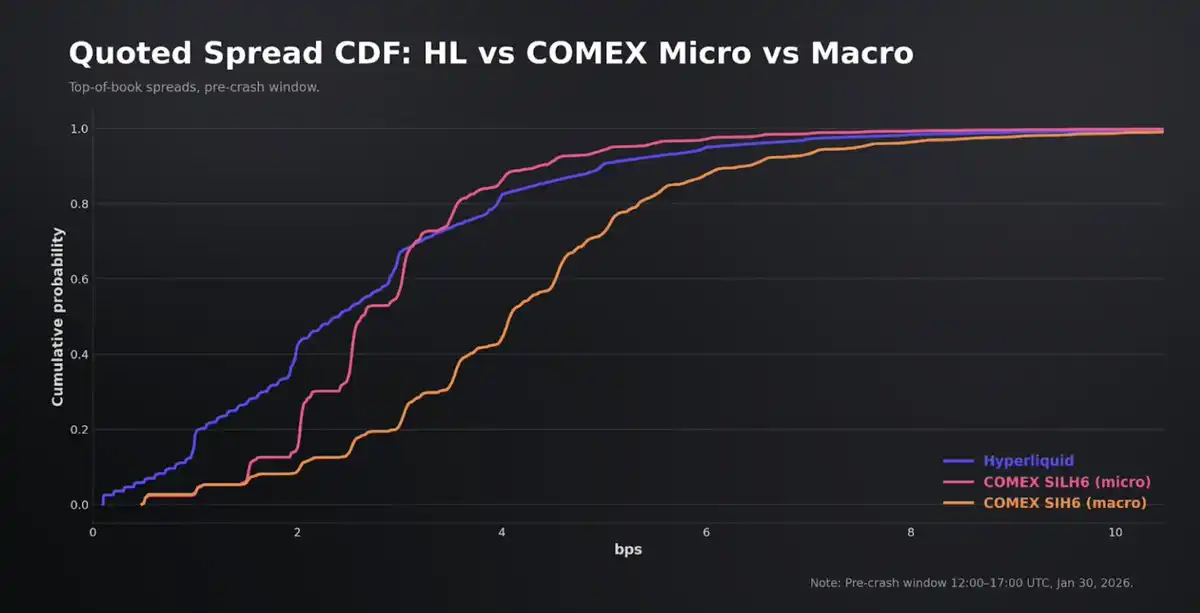

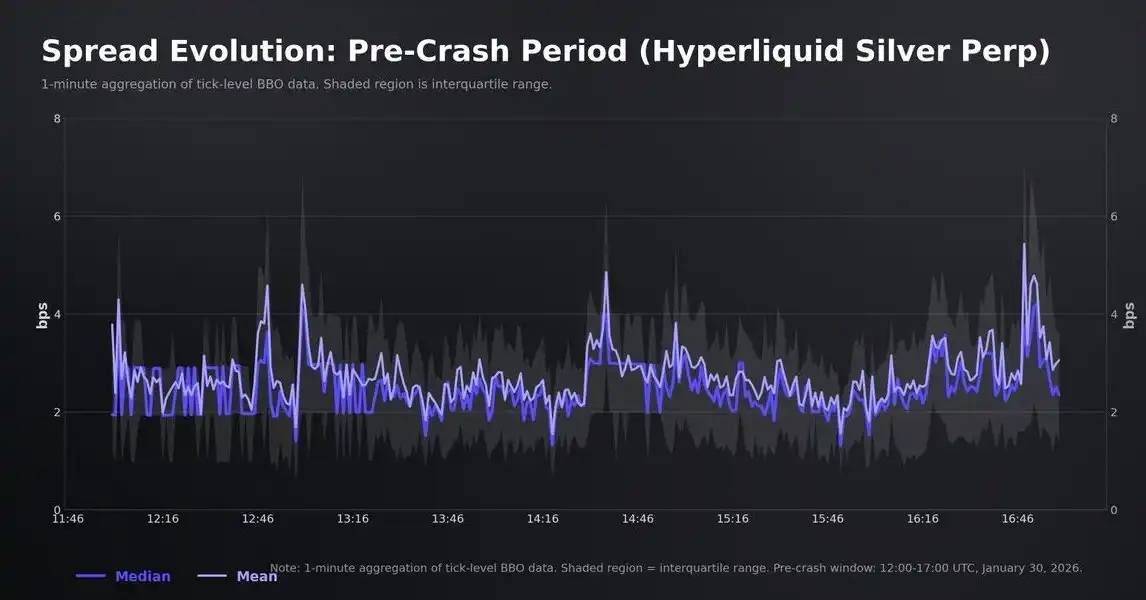

On the surface, Hyperliquid's Silver perpetual already behaves like a fairly mature market: quotes remain consistently tight, and activity is high. The top-of-book spread averaged 2.7 bps (median 2.4 bps), with 90% of observations at or below 5 bps.

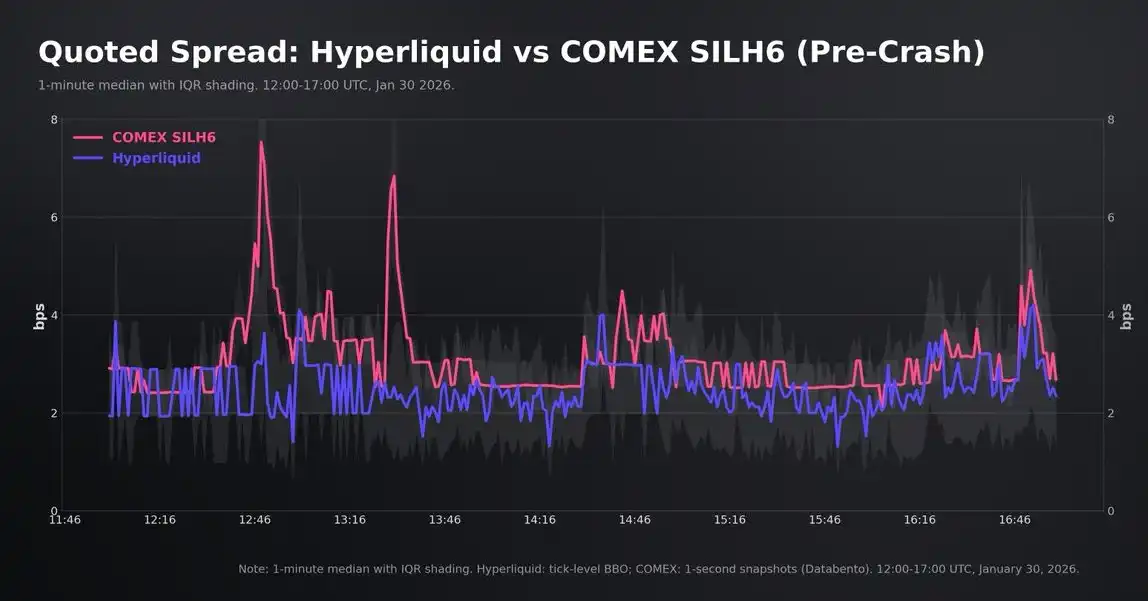

The natural benchmark is COMEX front-month Silver futures (SILH6), the most liquid tradable reference during overlapping hours. It must be noted that COMEX is structurally deeper and remains an institutional-grade liquidity venue. Our goal is not a simple comparison but to test whether Hyperliquid can provide reliable price integrity and execution for its mainstream order sizes while tracking the underlying benchmark.

During UTC 12:00–17:00, COMEX's notional volume was ~$85.5B, compared to Hyperliquid's $679M. Despite the vast scale difference, median spreads were very close: COMEX averaged ~3.1 bps, Hyperliquid averaged slightly narrower.

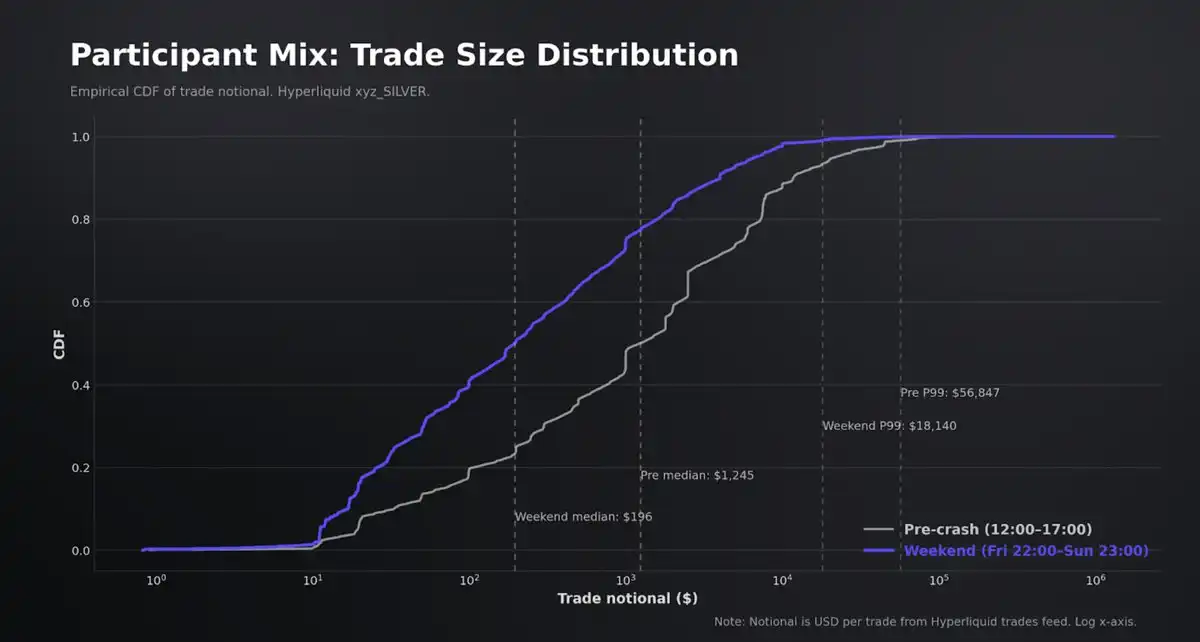

Nonetheless, COMEX's spread distribution was tighter in the tails, with 96% of observations within 5 bps, compared to 90% for Hyperliquid, consistent with deeper, more stable passive liquidity on major futures platforms. Furthermore, Hyperliquid's narrower quotes need context: its flows are more manageable and retail-skewed (average trade ~$5000, median $1190), which mechanically reduces "toxicity" at the top of the book.

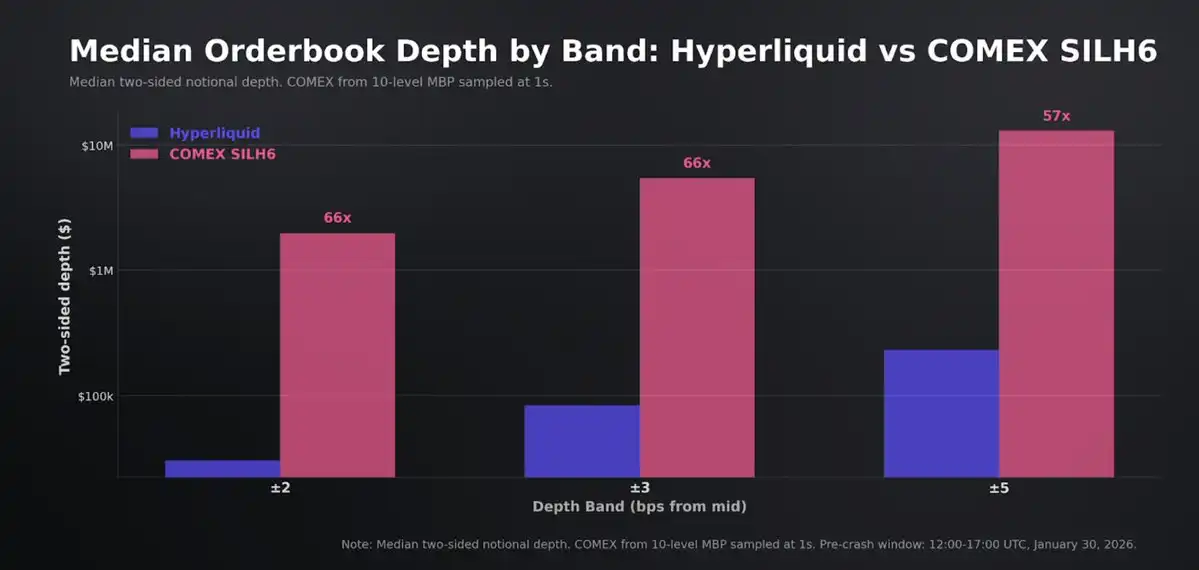

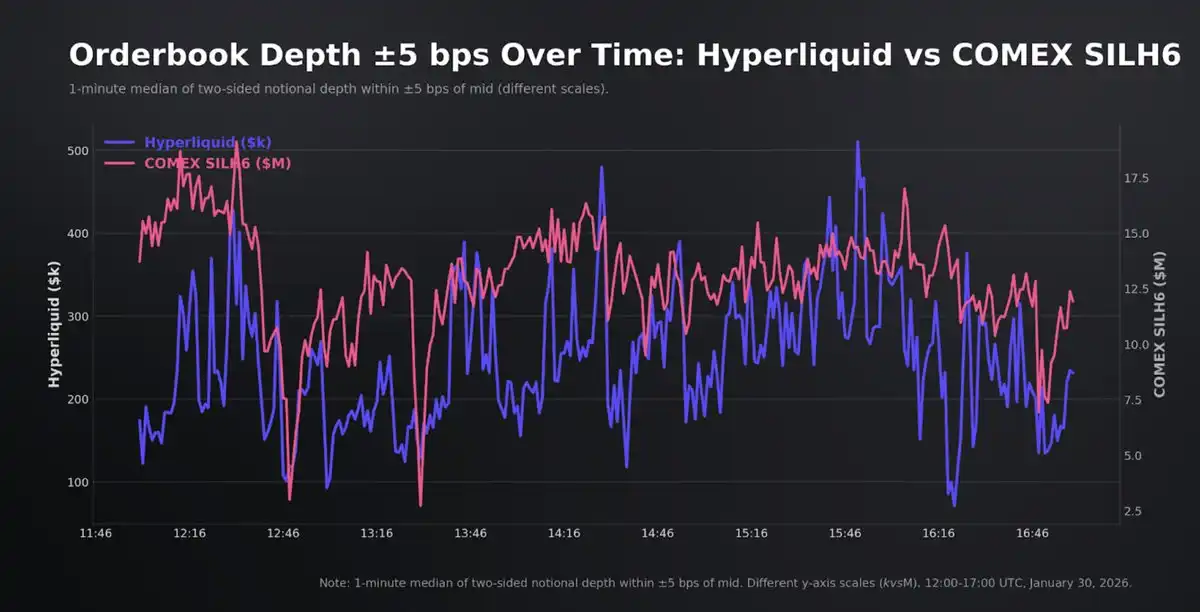

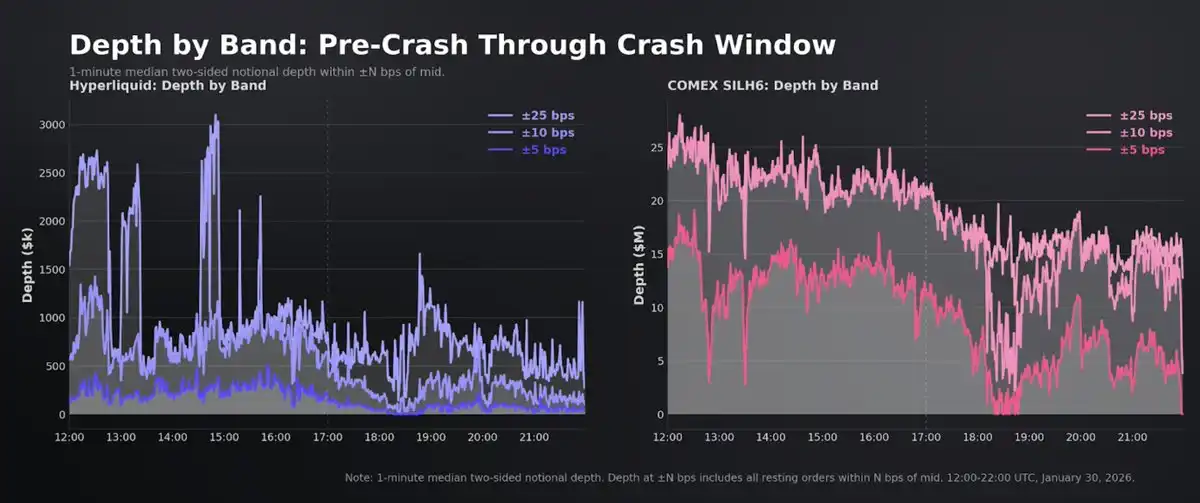

While top-of-book execution is comparable, liquidity depth is not. COMEX carried $1.98M within ±2 bps, Hyperliquid $30k; within ±3 bps, COMEX $5.45M, Hyperliquid $83k; within ±5 bps, COMEX $13M, Hyperliquid $231k. For retail orders crossing the spread, the narrower quote is a real advantage. For trades exceeding ~$50k notional, the depth gap determines the realized cost.

Even so, the depth shown by Hyperliquid is non-trivial for a platform without Designated Market Makers. The order book is largely symmetric, with bid/ask depth ratios near 1 at various levels, scaling from ~$231k within ±5 bps to $814k within ±10 bps and ~$1.5M within ±25 bps.

However, compared to traditional futures platforms, the depth shown by Hyperliquid is a weaker measure of "guaranteed execution." Matching occurs on an on-chain CLOB (Central Limit Order Book) with block-level sequencing, where order cancellations are processed before order placements within the same block. Thus, execution priority is partly determined by transaction type, not just time of arrival, weakening the association between "visible depth equals guaranteed fill volume" found in continuous offline matching engines like CME's.

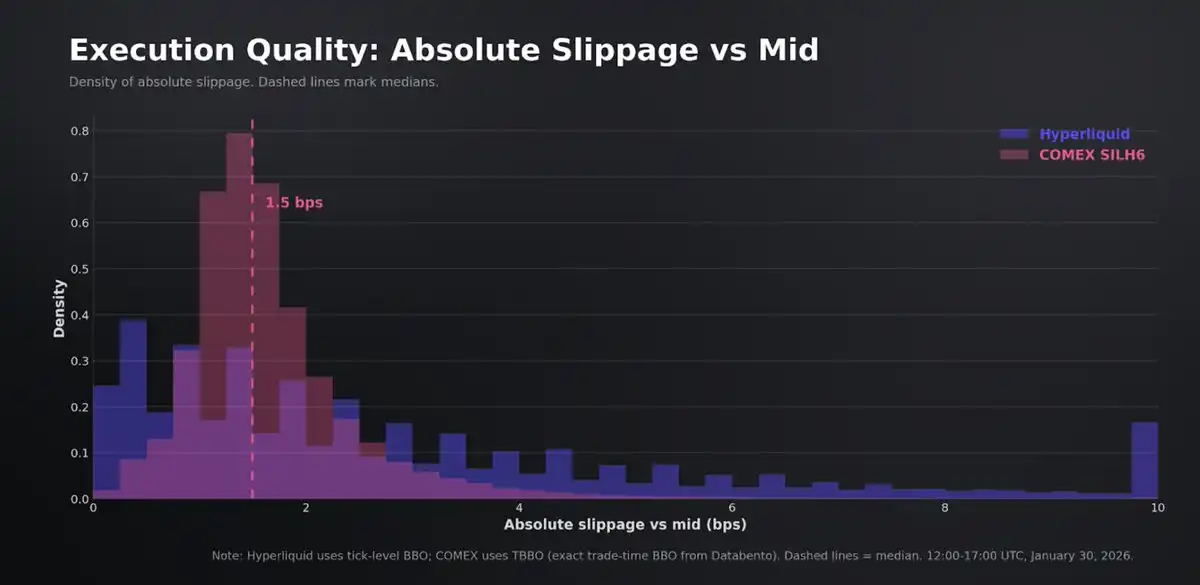

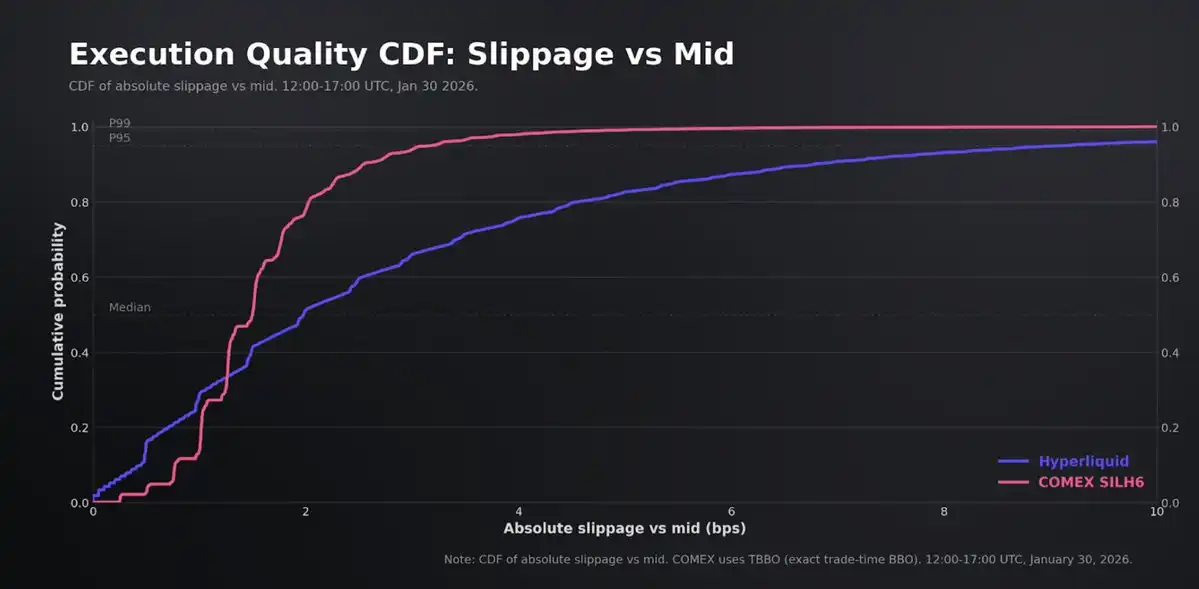

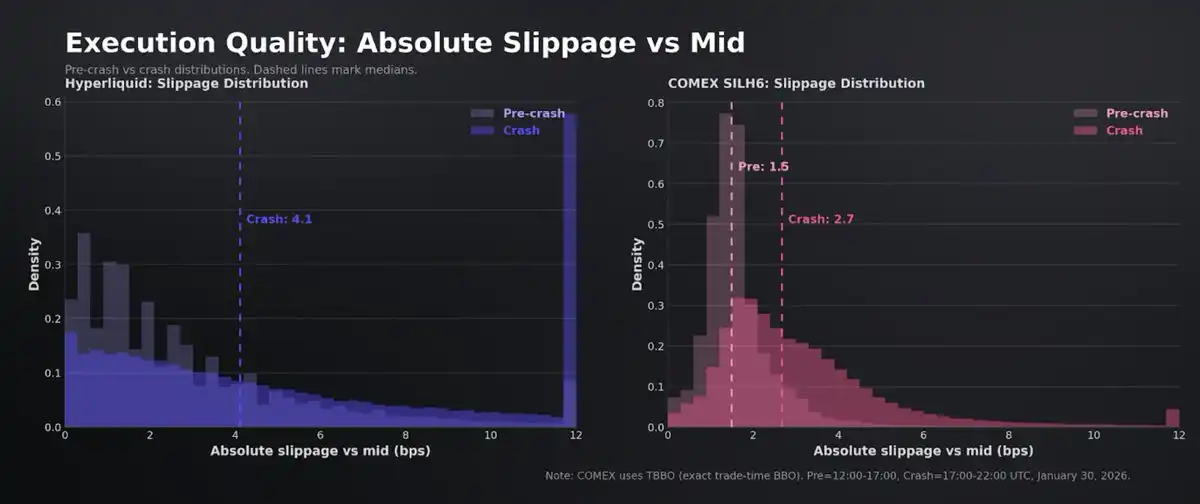

Execution quality provides information beyond spreads and depth. Using the best bid/offer (BBO) at the time of trade, the median trade slippage from the mid price was 1.5 bps on COMEX and 2.0 bps on Hyperliquid. COMEX execution was exceptionally tight, with 99% of trades within 5 bps of the mid. Hyperliquid's distribution was wider, with 83% within 5 bps and 96% within 10 bps, with occasional trades printing more than 20 bps from the mid, consistent with intermittent order book gaps and thinner carrying capacity.

Slippage increased slightly with trade size (COMEX ~1.5 bps for 1 lot, 1.6 bps for 2-5 lots), consistent with a deep order book. On Hyperliquid, the slope was steeper, rising from ~1.9 bps below $1k to ~2.8 bps above $50k. Notably, the execution gap between the two platforms is much narrower than the quoted depth ratio suggests. For Hyperliquid's median trade (~$1,200), the execution cost difference versus the COMEX median was only about 0.5 bps, even though COMEX's median trade size was much larger.

Finally, interpreting execution requires considering oracle and mark price design, as a trader might get filled on a deep but mispriced mark-to-market book. Under HIP-3, the oracle is a non-trading reference published by the deployer, with a fixed cadence and clamp mechanisms; the mark price governing funding, and liquidation is a robust aggregate of the oracle and local order book signals, also clamped to prevent violent moves. This separation allows the traded price to maintain a persistent premium or discount without mechanically forcing immediate liquidations, anchoring risk management to a slower-moving reference while still allowing continuous order-book-driven price discovery.

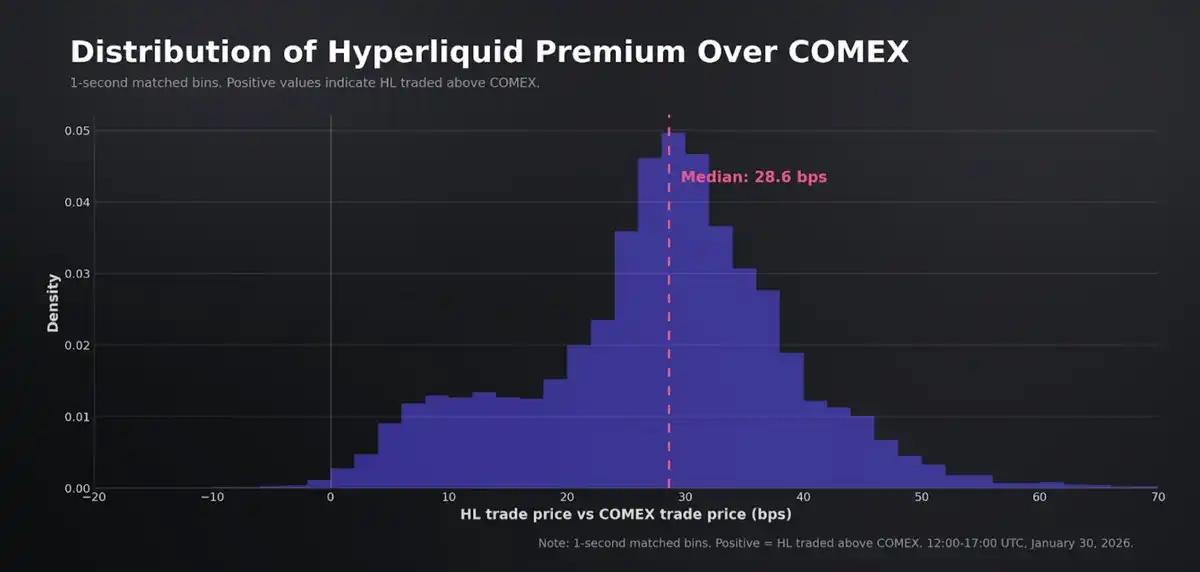

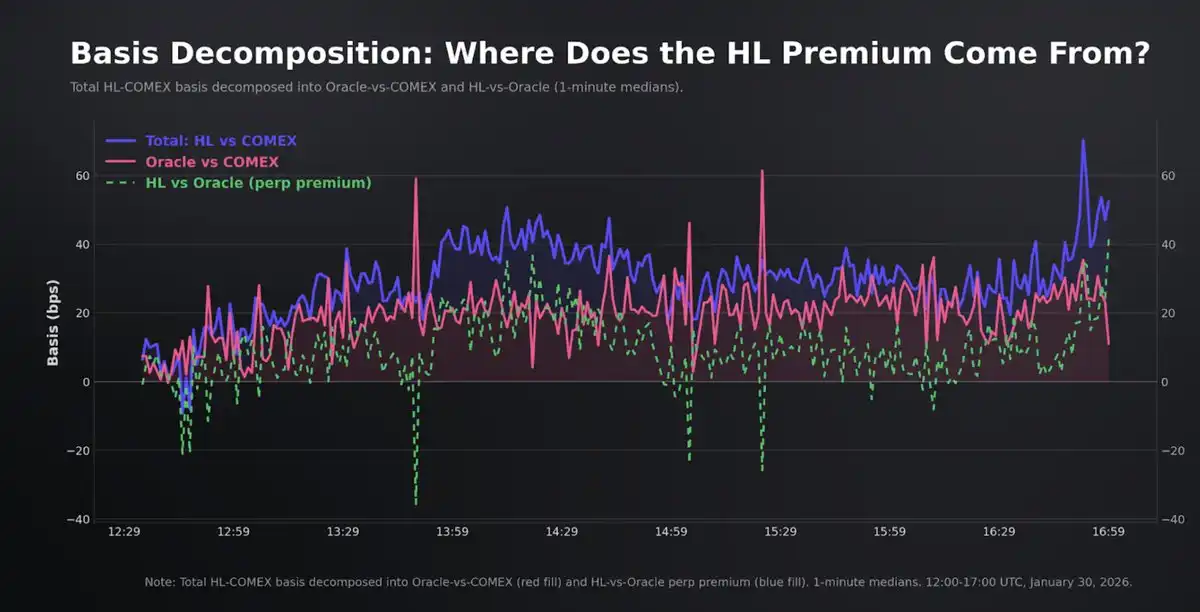

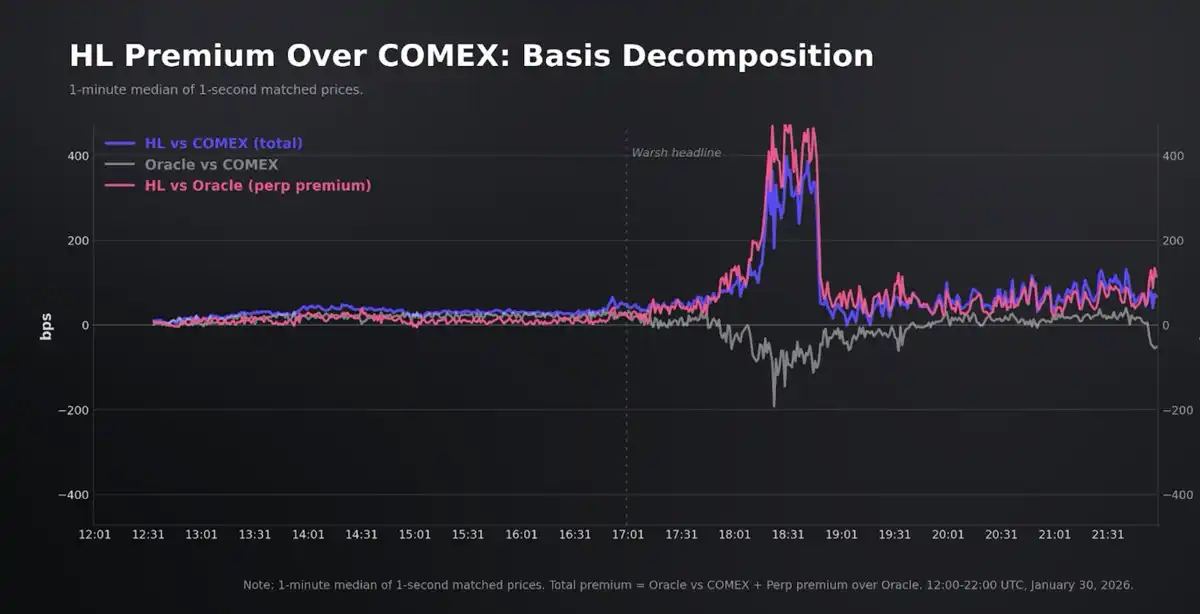

During the pre-crash window, Hyperliquid maintained a persistent premium of ~29 bps over COMEX. This premium decomposed into: oracle vs. COMEX portion (~18 bps, reflecting differences between the oracle's underlying basket and the front-month future) and perpetual vs. oracle premium (~9 bps, reflecting net long interest and funding pressure on the perpetual itself). The premium was very stable, with few inversions.

Comparing execution against the oracle showed a median premium of ~+9 bps.

In summary, pre-crash baseline data shows the platform provides clear settlement for its size and participant group, offering retail and midscale flows competitively tight pricing at the touch. Although Hyperliquid's depth is materially thinner across all levels, it still delivers spreads that are highly competitive, with median trade execution within 0.5 bps of the institutional benchmark, thanks to its smaller flow sizes.

The depth gap is real and economically significant for large orders and tail events. But given the typical trade sizes in this market, Hyperliquid was operating at a surprisingly high level of market quality before the decoupling began.

Market During the Crash

Around 17:00 UTC on Friday, Jan 30, reports surfaced that Trump was considering nominating former Fed Governor Kevin Warsh to replace Powell as Chair. As Warsh was widely seen as a monetary policy hawk, silver prices revalued sharply, experiencing their largest single-day drop since March 1980. Silver fell ~31% from Thursday's highs around $120/oz to an intraday low around $78. Leveraged long positions in futures, ETFs, and perpetuals faced simultaneous margin pressure, with forced liquidations becoming a significant component of the flow.

For perpetual platforms, this feedback loop can be self-reinforcing. As the reference price falls, market makers short the perpetual, and losing positions liquidate into the order book. If liquidity retreats faster than the liquidation flow can be absorbed, prints can skip multiple levels, widening the basis and increasing tail realized slippage.

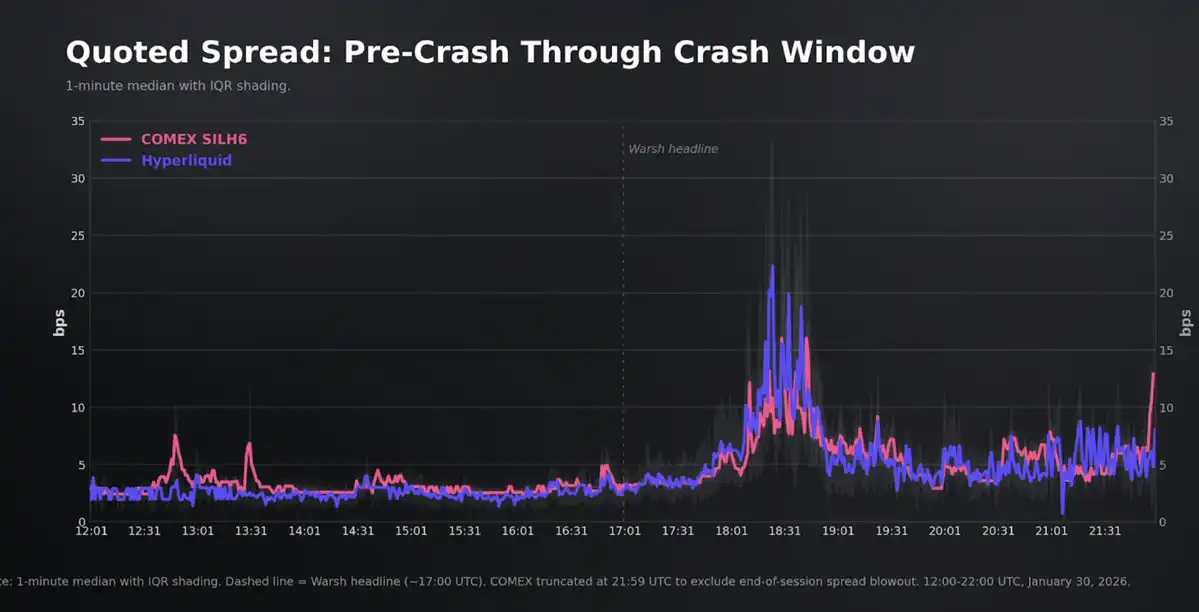

Quoted spreads deteriorated on both platforms, with Hyperliquid showing a larger tail reaction. On Hyperliquid, the median spread widened from 2.4 bps pre-crash to 5.1 bps during the crash (2.1x). The P95 rose from 6.0 bps to 18.2 bps, with only 49.5% of observations at or below 5 bps (vs. 90.5% pre-crash).

In the worst 5-minute window around 18:20 UTC, the median spread reached 17 bps. COMEX also widened, from a median of 3.0 bps to 4.8 bps (P95 12.7 bps), and maintained a tighter overall distribution. Its worst 5-minute window peaked at 10.1 bps at 18:20.

Similarly, depth retrenchment reflected the ebb of liquidity. On Hyperliquid, depth within ±5 bps fell from ~$231k pre-crash to $65k median across the crash window, and was zero median at the peak of the crash—primarily because the spread itself had widened beyond the ±5 bps range.

At wider levels, liquidity persisted even at peak stress: $542k within ±25 bps, ~$1.07M within ±50 bps. COMEX showed the same mechanical pattern at narrow levels (±2 and ±3 bps were often zero at peak), but absolute capacity remained an order of magnitude higher. At peak stress, COMEX still held ~$1.16M within ±5 bps, compared to ~$0 for Hyperliquid.

Execution quality degraded at the median on both platforms, but tail performance diverged. Hyperliquid's median trade slippage from mid rose from 2.0 bps to 4.1 bps (~2x), COMEX from 1.5 bps to 2.7 bps (~1.8x). COMEX maintained execution tightness, while Hyperliquid developed a heavy tail: ~1,900 Hyperliquid trades (1% of crash volume, ~$21M notional) executed more than 50 bps from the mid; COMEX had none.

Due to lower liquidity and liquidation flow, Hyperliquid's mark price did eventually deviate from the oracle. The HL-COMEX basis peaked at 463 bps at 18:30 UTC but held above 400 bps for only 95 seconds and retraced from the peak to below 50 bps within 19 minutes. Spreads followed a similar trajectory.

Overall, Hyperliquid's spreads widened more, and the execution distribution developed a heavy tail, consistent with a thinner order book under liquidation flow. However, the deviation was not sustained. In volatility not seen in decades, Hyperliquid remained continuously tradable and largely anchored to the benchmark, with the main point of degradation concentrated in tail execution during the fastest moves.

Market Close

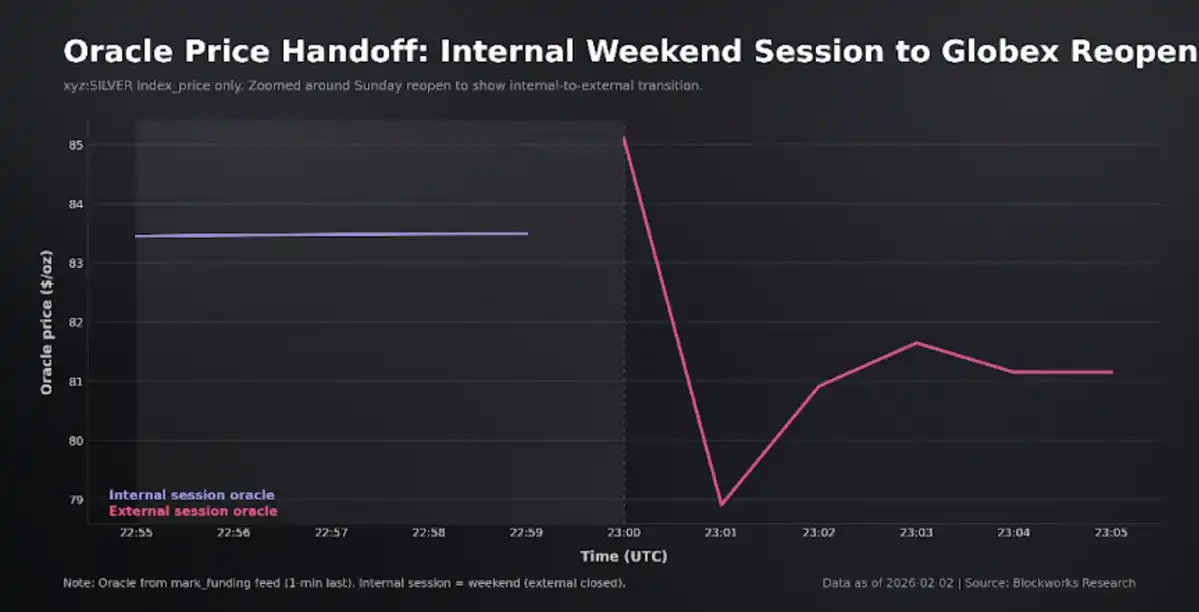

At 22:00 UTC Friday, COMEX closed, pausing the traditional institutional reference loop for silver price formation. Hyperliquid remained open. For HIP-3 perpetuals, this is a special regime where external oracle updates are unavailable, and the platform transitions from an "externally anchored" to a "constrained internally guided" reference process.

Deployers continue to publish the index but advance it using order-book-derived impact prices filtered through a slow EMA. The mark price governing margin and liquidation is a robust mix of the index, a short-period basis filter, and local order book signals, bounded by discovery limits tied to max leverage (~5% bands for silver).

The weekend mechanism theoretically enables price discovery during non-trading hours. When the external oracle resumes on Monday, this internal price is pulled back to the external reference, but this intermediate window allows traders to position around Friday's anchored level ahead of the opening auction.

Trading continuity was high throughout the weekend window: 175k trades, $257M volume. Participant composition skewed significantly more retail than normal hours. The median trade size dropped to $196 (vs. $1,245 previously), and the 99th percentile fell to $18.1k.

In this dimension, quoted liquidity tightened significantly. The weekend median top-of-book spread was 0.93 bps, compared to 2.40 bps on normal trading days. Depth decreased but remained stable and two-way balanced. The median two-way depth within ±10 bps was $358k. Execution followed the same pattern.

Using the mid price at the time of trade, the median weekend slippage was 0.87 bps, versus 1.98 bps during normal hours. In other words, for the trade sizes dominating weekend flows, the cost of crossing the spread was lower than on weekdays, despite weaker absolute depth carrying capacity.

In terms of price performance, the weekend price was volatile, not static. The silver price moved from 85.76 to 83.70 by the reopen within the weekend window, with all-day trading producing a reference that actually moved.

The Globex reopen provides the clearest cross-platform check on whether weekend trading produced a usable reference level. At 23:00:00 UTC, COMEX's first print was ~97 bps above the Hyperliquid mid price. By 23:00:01, the gap had compressed to ~10 bps. Hyperliquid's continuous weekend market produced a price level very close to COMEX's opening auction. Impressively, the final internal price on Sunday was closer to Monday's open than Friday's close was.

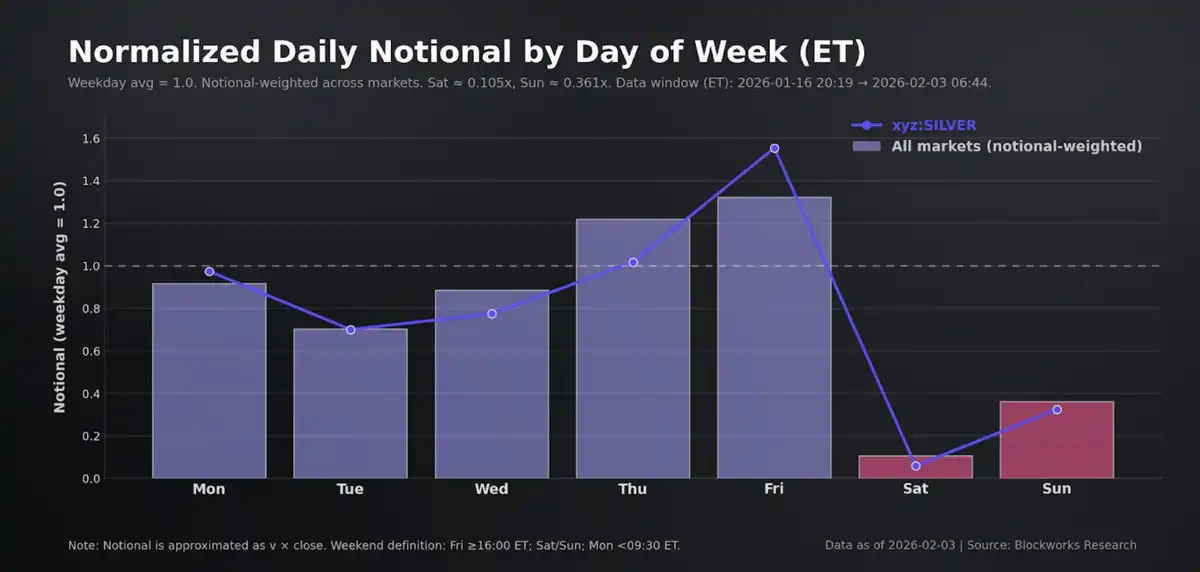

Across all HIP-3 markets, weekends are structurally low-participation periods, even though trading is continuous. Analyzing 32 xyz markets using 5-minute candles (defining weekend as Friday 16:00 ET to Monday 09:30 ET), we find: On a notional-value-weighted-by-weekday basis, notional value per 5-minute candle falls to 0.31x weekday levels (a 69% drop); on an equal-weighted average basis, it falls to 0.33x (a 67% drop).

Volatility also contracts, but less than volume. On a notional-weighted basis, 5-minute realized volatility falls to 0.75x weekday levels (a 25% drop), with a median market drop of 36%. A subset of markets shows limited contraction or even higher weekend volatility, attributable to differences in underlying reference market hours and the dynamics of the Sunday evening reopen, which by definition is still counted as "weekend."

Silver fits this pattern perfectly. xyz:SILVER's notional per 5-minute candle fell 72%, while 5-minute realized volatility fell only 21%. Tighter spreads and stable median execution can coexist with lower overall participation and reduced depth away from the touch. In other words, weekend trading is optimized for continuity and small-clip execution, not institutional-grade size. Despite the significant volume drop, Hyperliquid provides compact execution quality for the small-sized flows that dominate this period.

The Promise of 24/7 Trading

Given this structure, one of the most practical use cases for Hyperliquid's 24/7 perpetuals is pricing the COMEX Sunday reopening auction. On COMEX, the Sunday open is a single-price call auction: orders accumulate pre-open, a reference opening price is published, and there's a brief non-cancelable window to lock the book before continuous matching resumes. The opening price is chosen to maximize executable volume, then minimize residual imbalance, with tie-breakers adjudicated against previous settlement prices or other references. This is effective for clearing backlogged order flow, but it also concentrates information, hedging demand, and stop flows into a discrete price point.

A continuously trading venue like Hyperliquid changes the execution puzzle because it allows participants to express and transfer risk before the auction compresses the spread. Instead of passively accepting the reopening auction's final print, traders can stage entries at real-time order book prices throughout the weekend. Effectively, Hyperliquid provides a tradable weekend reference and a path-dependent execution plan for size, timing, and price limits that doesn't exist while the COMEX book is closed.

As the oracle handoff chart shows, traders can trade against the internal pricing during the weekend before the auction. When external reference pricing resumes, this anchor is pulled back to the oracle, creating an economic incentive for traders to price this gap. The nuance is that this edge depends on weekend liquidity and nominal capacity, but when these constraints are met, Hyperliquid shows an execution advantage.

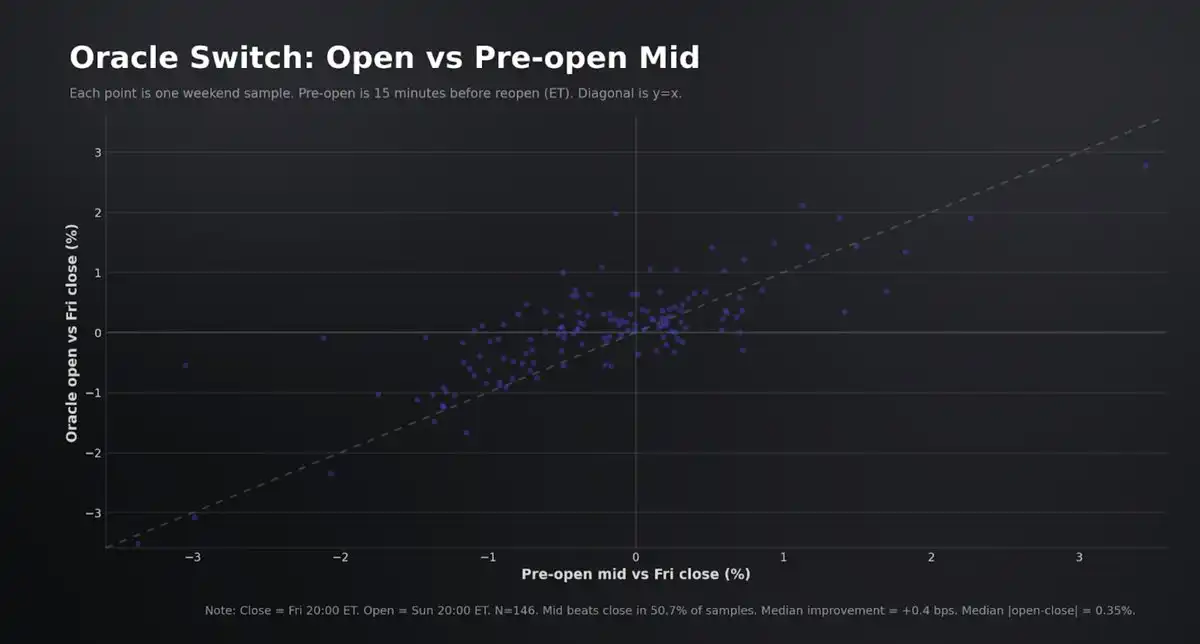

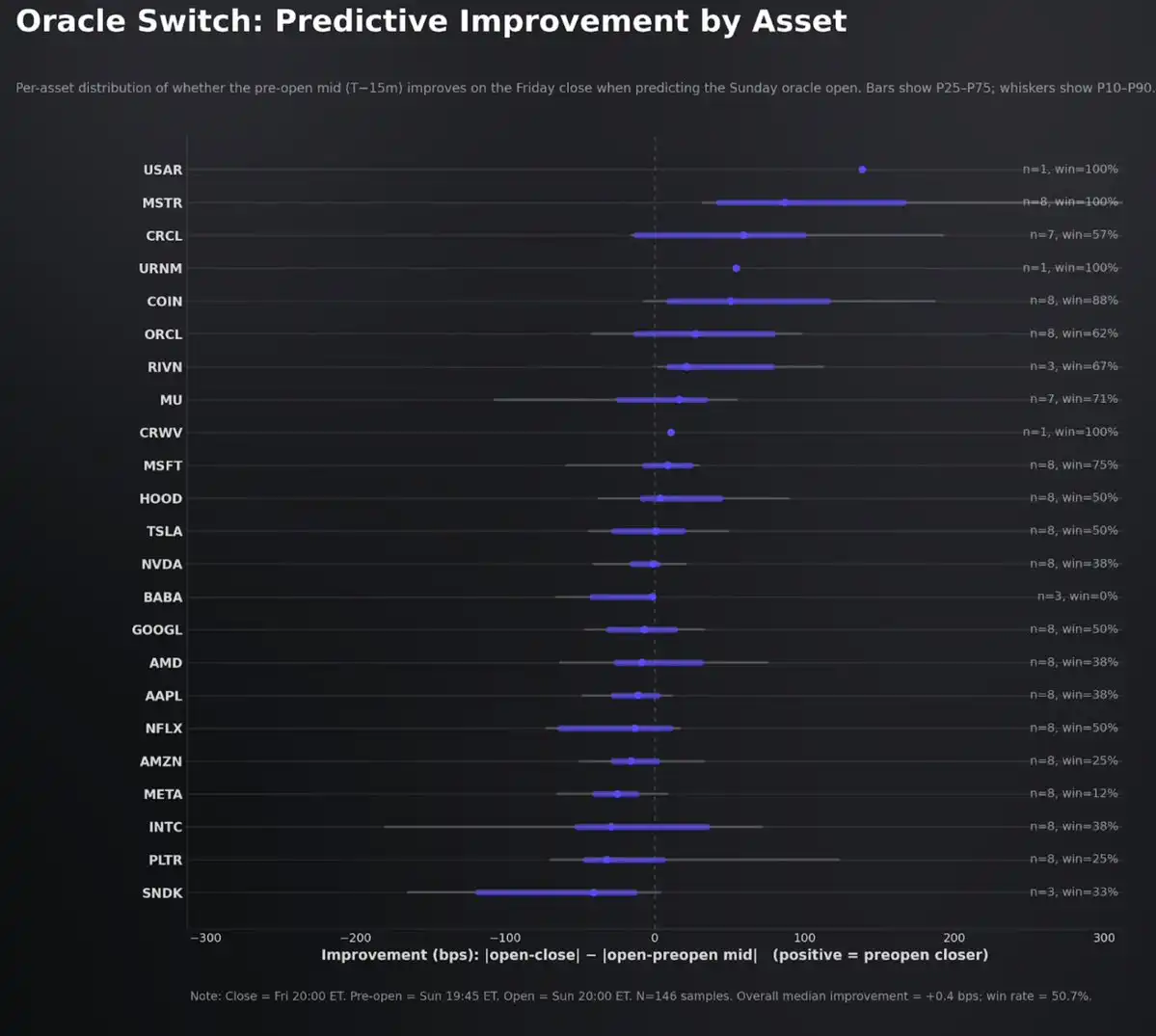

Across all xyz equity HIP-3 markets, we tested whether internal session pricing provided incremental price discovery before the Sunday oracle reopen. The comparison was: the oracle open's move vs. the Friday close, versus the move in the mid price observed 15 minutes before the reopen (both measured as a percentage of the Friday close).

In the current sample (23 markets; 191 weekend samples, 146 with valid pre-open mid snapshots), evidence for incremental weekend price discovery at the oracle level is weak. In 50.7% of observations, the pre-open mid was closer to the oracle open than the Friday close was, with a median improvement of ~+0.4 bps, essentially negligible.

In other words, for these markets, the oracle open remains largely anchored to the Friday close, and deviations in the internal session mid do not persist when the external oracle resumes. This suggests that, at least for equities under the current HIP-3 configuration and liquidity regime, weekend trading has not yet produced a robust, strongly referential tradable benchmark. Nonetheless, as liquidity and depth build, we expect the internal session to become a more reliable pricing reference ahead of the reopen.

Conclusion

Hyperliquid's HIP-3 Silver perpetual cleared settlement smoothly through volatility not seen in decades, without downtime, and provided competitively tight touch pricing for mainstream retail and midscale flows. Market quality degraded under stress as expected, particularly in tail execution, but the imbalance was short-lived, the basis mean-reverted quickly, and price formation remained largely anchored to the institutional benchmark. The constraint for HIP-3, however, is capacity; the platform handles small-to-medium sized orders well, but execution for large orders remains materially constrained relative to COMEX's depth.

Beyond the standard advantages of perpetuals, the weekend regime is where the product's strategic value is most apparent. Hyperliquid provides a continuous price path when traditional markets are closed, turning a discrete reopening gap into a tradable reference, creating an edge in pre-auction positioning and open pricing.